Wealth Management on the verge of a new era ?

As we slowly move out of the pandemic, financial services firms have learned the criticality of virtual engagement to business resilience. Wealth management firms more and more need capabilities to cater to new-age clients and deliver new-age services.

Capgemini’s report aims to understand and analyze the top trends in the Wealth Management industry this year and beyond.

Discover the main trends currently shaping the Wealth Management industry and how financial institutions can best address them.

A conversation between Elias Ghanem Capgemini’s Global Head of Market Intelligence and Frédéric Kemp Azqore’s Chief Market Officer.

The following paragraphs present the 2022 Wealth Management trends identified by Capgemini.

Download Capgemini Brochure

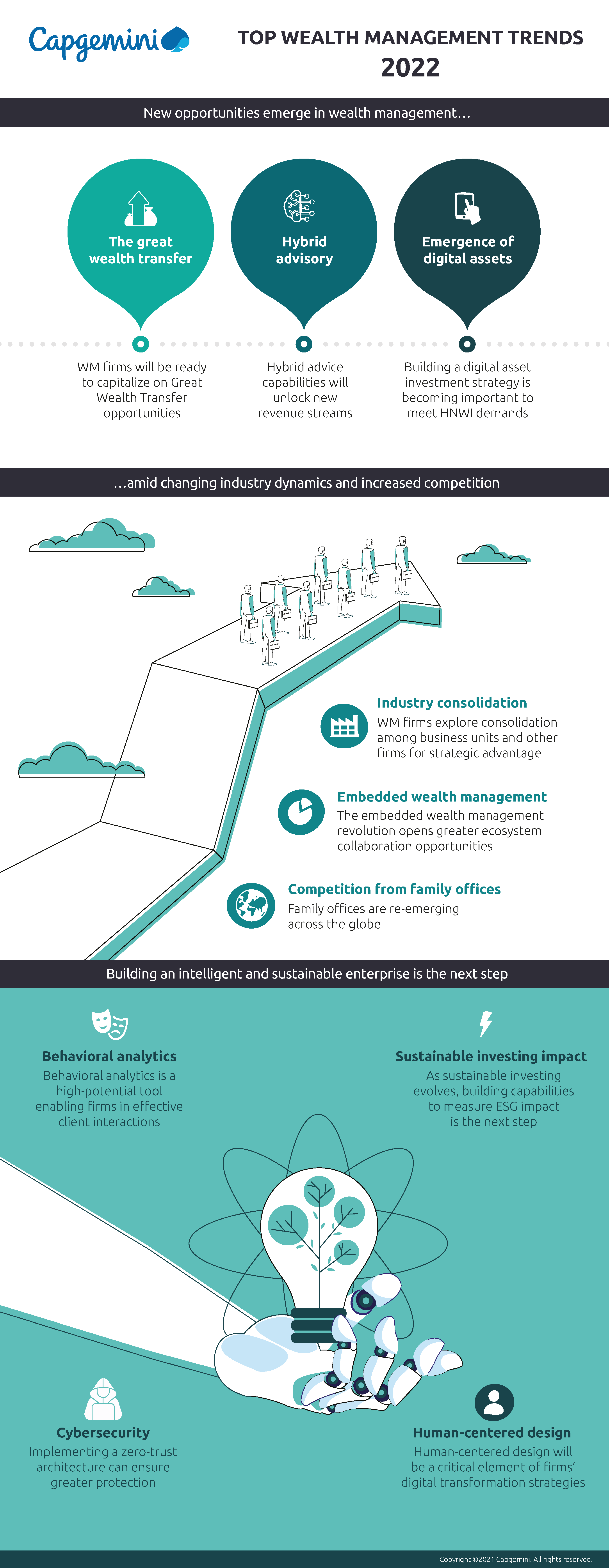

TOP WEALTH MANAGEMENT TRENDS 2022

Summary

2022 trends influenced by the shadow of the recent past.

A year ago, Capgemini Top Trends in Wealth Management report emphasized how the pandemic sparked disruption and digital transformation and changing investor attitudes around Environmental, Social, and Corporate Governance (ESG) products. As we begin 2022, many of those trends continue to hold as COVID-19’s wide-reaching effects continue to influence the wealth management industry.

As wealth management (WM) firms supercharge their digital transformation journeys, expect investments in cybersecurity and human-centered design to be critical to building superior digital client experience (CX). Another holdover trend − sustainable investing – is gaining mainstream attention and generating increasingly sophisticated client demands. Therefore, in 2022 and beyond, wealth management firms will need to bolster their capabilities to measure compliance with ESG standards when making recommendations for sustainability-based portfolios. Data and analytics capabilities will become ever more essential. Notably, firms can leverage behavioral analytics to strengthen client stickiness by identifying investors’ patterns − starting by understanding a prospect’s perception of the firm to, ultimately, offering personalized CX across the entire client journey.

WM firms continue to face significant revenue and margin pressures. Competition as well as collaboration opportunities are up as family offices re-emerge significantly and FinTechs explore embedded wealth management. Firms are also exploring new growth and profitability avenues such as consolidating business units and partnering with other firms for strategic advantage, bracing for the great wealth transfer, and preparing for investor demand for hybrid advice and digital assets.

As large financial services firms refocus on their wealth management business while new digital players make industry strides, competition is becoming historically intense. Not surprisingly, client experience is the new battleground.

Find out more about Capgemini

TABLE OF CONTENTS

TREND 1 - STRATEGIC WM FIRMS WILL BE READY TO CAPITALIZE ON GREAT WEALTH TRANSFER OPPORTUNITIES

TREND 2 - WEALTH MANAGEMENT FIRMS EXPLORE CONSOLIDATION AMONG BUSINESS UNITS AND OTHER FIRMS FOR STRATEGIC ADVANTAGE

TREND 3 - FAMILY OFFICES MAKING A RESURGENCE − WORLDWIDE

TREND 4 - A DIGITAL ASSET INVESTMENT STRATEGY IS BECOMING IMPORTANT

TREND 5 - CYBERSECURITY BECOMES A TOP PRIORITY FOR WEALTH FIRMS

TREND 6 - HUMAN-CENTERED DESIGN WILL BE CRITICAL TO WM FIRMS’ DIGITAL TRANSFORMATION STRATEGIES

TREND 7 - HYBRID ADVICE CAPABILITIES WILL UNLOCK NEW REVENUE STREAMS

TREND 8 - AS SUSTAINABLE INVESTING EVOLVES, BUILDING CAPABILITIES TO MEASURE ESG IMPACT IS THE NEXT STEP

TREND 9 - BEHAVIORAL ANALYTICS ENABLE FIRMS IN EFFECTIVE CLIENT INTERACTIONS

TREND 10 - THE EMBEDDED WEALTH MANAGEMENT REVOLUTION OPENS GREATER ECOSYSTEM COLLABORATION OPPORTUNITIES

Please find an abstract of the most relevante trends for Azqore.

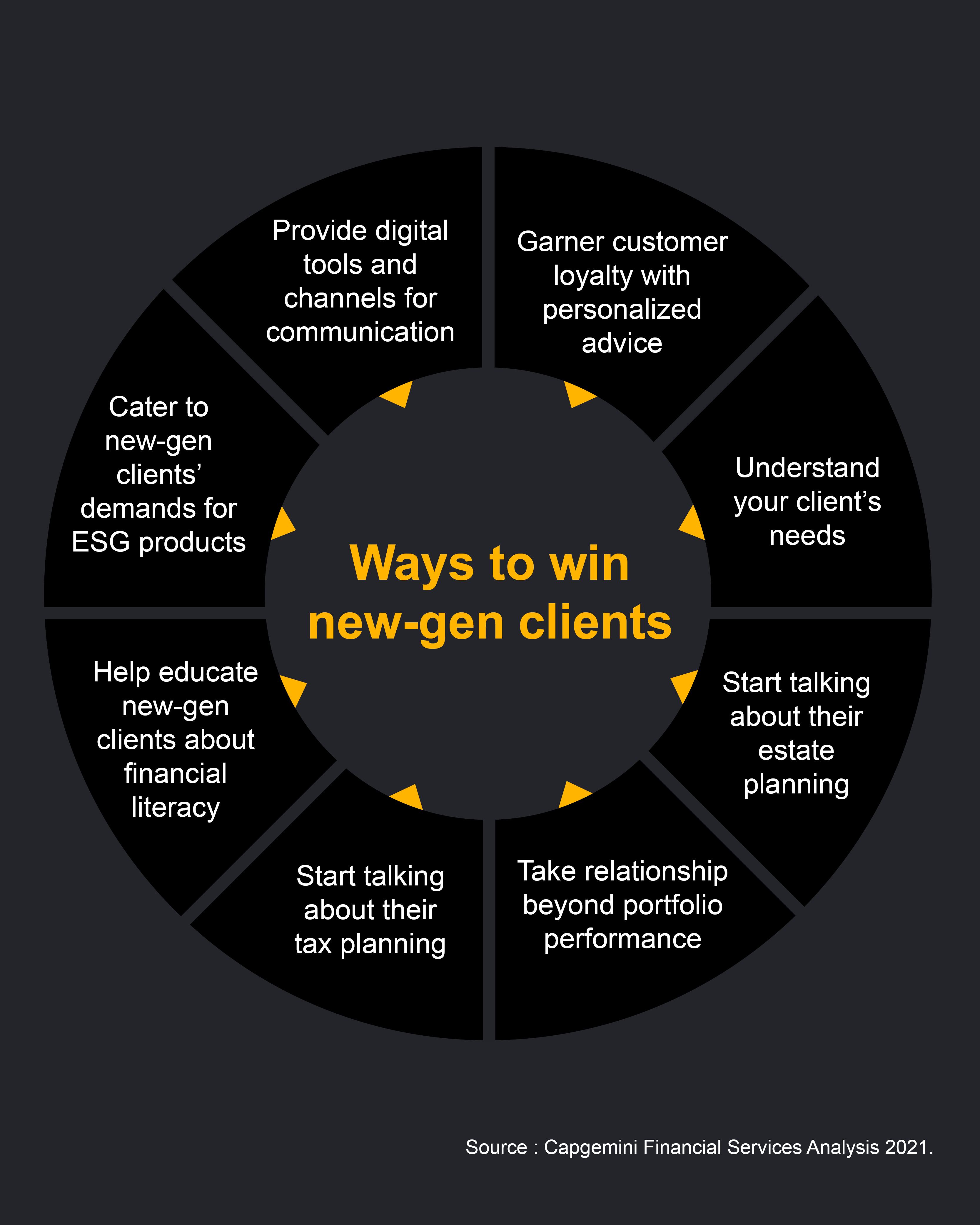

TREND 1 - WM FIRMS GEARED TO CAPTURE OPPORTUNITIES FROM THE GREAT WEALTH TRANSFER

The most significant intergenerational wealth transfer in history – from Baby Boomers to Gen X, millennials, and Gen Z – is beginning. Preparation is critical.

Speculation about the exact amount and the timing of the wealth transfer varies. Forbes reports USD30 trillion over many years. PNC says USD59 trillion by 2061. CNBC predicts USD68 trillion over 25 years. The New York Times confirms the variety of these assessments but forecasts ≈USD15 trillion over the next decade.1 And Barclays estimates USD7.5 trillion globally within the next three decades.2 Whatever the amount and timing, a significant opportunity for wealth managers is imminent. Therefore, it is time to build a diverse staff that aligns with changing client demographics.

- Wealth advisors and planners across the globe are beginning to advise an aging client population starting to think about legacy and estate planning.

- Financial literacy and knowledge are essential when wealth ownership is poised to change hands. Thus, wealth advisors are crucial in bridging the knowledge gap throughout the great wealth transfer.

1. Vox, “The impact of inheritance,” March 23, 2021. 2. Barclays, “Are you ready for ‘The Great Wealth Transfer’?” May 27, 2021.

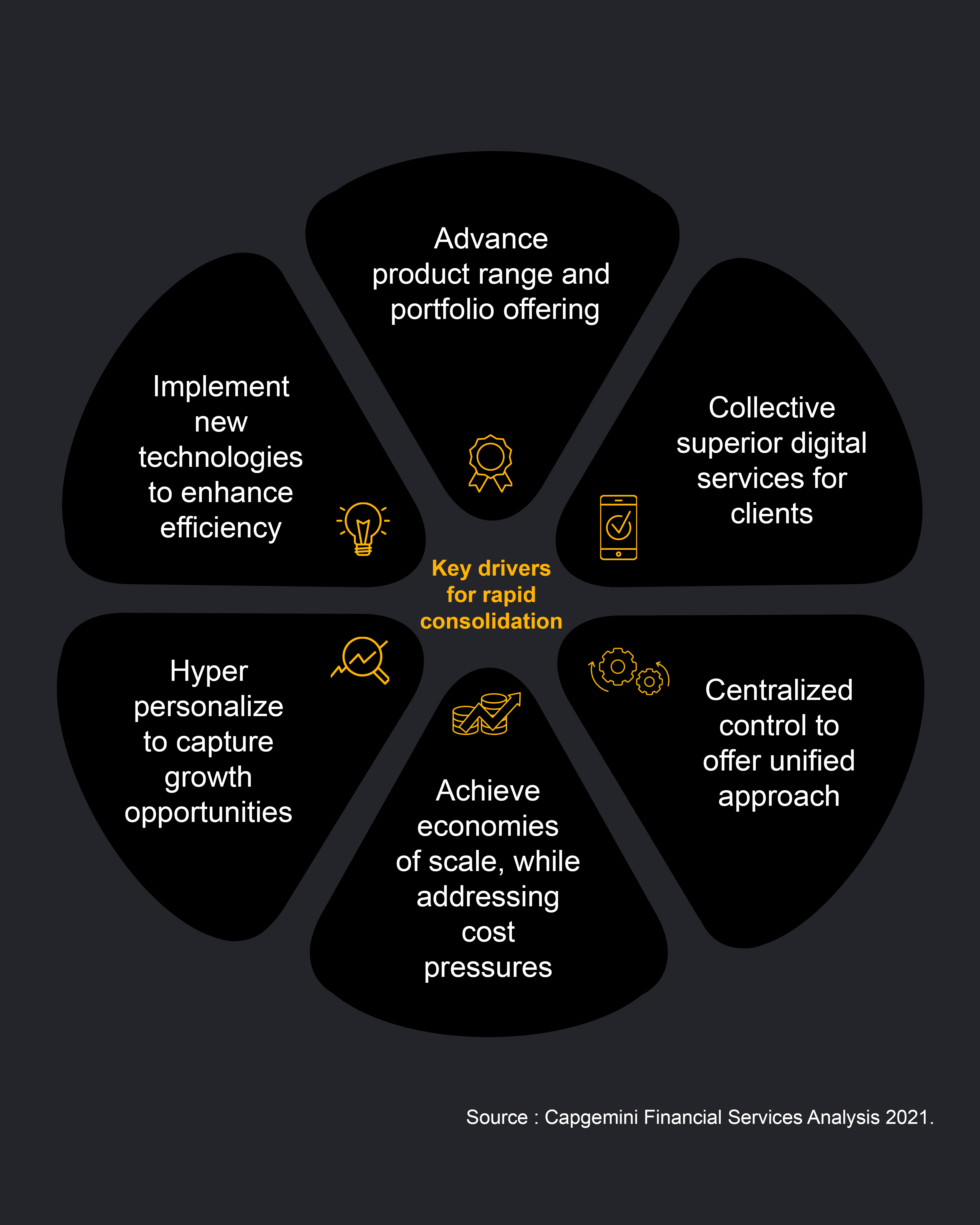

TREND 2 - WEALTH MANAGEMENT FIRMS EXPLORE CONSOLIDATION AMONG BUSINESS UNITS AND OTHER FIRMS FOR STRATEGIC ADVANTAGE

A unified business model has become more prevalent in the industry to provide hyper-personalized services and gain a strategic foothold in an ever-competitive market.

- Industry consolidation has been on the rise for nearly two years, with significant developments within and between firms.

– According to Echelon Partners, ~205 transactions took place in 2020 to set an eight-year record high, up from 203 in 2019.

Also, the value of US investment management M&A activity in 2020 was ≈ USD28-billion, the highest overall deal value in the sector since USD29 billion in 2000. 3,4

- Moving forward, it is likely that more records will be broken as firms up their games to stay competitive, keep up with technological developments, innovate, and cater to clients through hyper-personalized solutions.

- Consolidations are addressing process redundancies by unifying business models.

3. NAPA, “2020 M&A Activity Unfazed by Pandemic; Will 2021 Be the Same?,” January 27, 2021. 4. Business Insider India, “Taking stock of a remarkable year in asset and wealth management,” December 28, 2020.

TREND 6 - HUMAN-CENTERED DESIGN WILL BE A CRITICAL ELEMENT OF FIRMS’ DIGITAL TRANSFORMATION STRATEGIES

As firms step up digital transformation, they are embedding customer centricity and advisor centricity in product and interface designs to ensure a superior last-mile experience

Digital transformation delivered evolutionary changes throughout the financial services industry, including wealth management.

However, a human-centric digital makeover will be essential to securing client relationships.

- The wealth management industry has always been known for its reliance on human advisor expertise and personal connections. Thus, even as firms accelerate their digitization efforts, a combination of human touch and technology-driven efficiency will be an essential element in the future.

- A digital experience that prioritizes emotions and empathy will drive client satisfaction through the last mile.

- Hence, banks/industry participants will need to adopt and integrate technology with emotional engagement to attract new clients and tap into additional opportunities.

TREND 8 - AS SUSTAINABLE INVESTING EVOLVES, BUILDING CAPABILITIES TO MEASURE ESG IMPACT IS THE NEXT STEP

HNWIs are demanding more information on sustainable investing and ESG impact, making it essential for companies to develop the necessary ESG scoring capabilities

Pandemic disruption is among numerous events encouraging corporations and investors to pick a lane regarding environmental, social, and governance (ESG) standards.

- Interest in ESG is taking center stage as investors channel more funds into vehicles that deliver societal impact along with financial returns.

- A Bloomberg Intelligence Report predicts that global ESG assets will exceed USD53 trillion by 2025, accounting for approximately a third of total projected assets under management − USD140.5 trillion.5

5. Bloomberg, “ESG assets may hit $53 trillion by 2025, a third of global AUM,” February 23, 2021.

TREND 9 - BEHAVIORAL ANALYTICS IS A HIGH-POTENTIAL TOOL ENABLING FIRMS IN EFFECTIVE CLIENT INTERACTIONS

Firms are weaving behavioral analytics into business models and client engagement practices.

Behavioral finance enables firms to study the impact of psychological and emotional influences on the investment behavior of clients and advisors. Behavioral analytics can help firms better understand their clients and engage with them accordingly.

- An increasing number of financial services firms − powerfully equipped with artificial intelligence and data analytics capabilities − are applying behavioral precepts to enhance corporate culture and operations and guide clients down desired

investment paths.6 - During the onset of the pandemic and in a period of unprecedented volatility, firms say behavioral finance helped advisors gain new clients, cement trusting relationships, and keep clients invested for their long-term goals.

– According to the BeFi Barometer 2020, 66% of WM respondents said they gained clients in the first three months of 2020

thanks to the aid of behavioral finance, compared with 36% who did not use behavioral tools.7

6. GARP, “Behavioral Finance Theory Gets Real in Risk Management,” July 9, 2021. 7. WealthBriefing, “Wealth Advisors Increasingly Use Behavioural Finance To Win, Counsel Clients,” September 10, 2020.

OTHER TRENDS

Find out more, download the brochure

DOWNLOAD CAPGEMINI BROCHURE